State-run auto-enrollment IRA programs expand access

State-run auto-enrollment IRA programs automatically enroll employees into retirement savings plans, simplifying the savings process and increasing participation rates while allowing workers to adjust their contributions as needed.

State-run auto-enrollment IRA programs grow nationwide, enabling more people to save for retirement conveniently. But how do these programs really work, and what benefits can they bring you? Let’s dive into the details.

Understanding state-run auto-enrollment IRA programs

Understanding state-run auto-enrollment IRA programs is crucial for maximizing retirement savings. Many states have begun implementing these programs to help workers save more effortlessly.

These IRAs are designed to automatically enroll employees, meaning they don’t have to take extra steps to start saving for their retirement. Essentially, once eligible, employees are automatically signed up to contribute a percentage of their paycheck to an IRA unless they choose to opt out.

Key Features of Auto-Enrollment IRAs

Here are some key features that make these programs beneficial:

- Automatic Participation: Employees are enrolled by default.

- Flexible Contribution Rates: Workers can usually choose their contribution level.

- Tax Benefits: Contributions often reduce taxable income.

- Portability: The IRA is vested regardless of job changes.

With state-run auto-enrollment IRA programs, the cumbersome process of signing up for retirement savings is streamlined. This encourages more people to save who might otherwise hesitate. By facilitating automatic savings, these programs contribute to a more financially secure future.

How Do Contributions Work?

Contributions in these programs typically start at a low percentage of an employee’s salary, usually around 5%. However, workers can adjust their contributions at any time to fit their financial situation. The goal is to make saving convenient and effective while eliminating barriers that might discourage participation.

In addition to ease of use, many programs are designed to educate employees about the importance of saving early for retirement. This education can lead to more informed decisions about their financial futures.

As these programs continue to grow, they are reshaping the retirement landscape. More individuals are beginning to take advantage of the benefits without needing to navigate complex processes. Understanding how state-run auto-enrollment IRA programs work can empower individuals to make better financial choices for their retirement.

Benefits of auto-enrollment for workers

The benefits of auto-enrollment for workers are significant and can lead to healthier financial futures. With this system, saving for retirement becomes a default action, helping individuals to develop positive financial habits without the extra effort of opting in.

One of the most appealing aspects is how easy it is for employees to start saving. Once they are enrolled, contributions are taken directly from their paychecks, which removes the temptation to spend that money elsewhere. This automatic process encourages consistent saving.

Key Advantages of Auto-Enrollment

Here are some key advantages to consider:

- Increased Participation: More workers save for retirement because they are automatically enrolled.

- Simplicity: It simplifies the process of saving, requiring minimal action from workers.

- Early Savings: Employees benefit from the power of compounding interest by starting their savings early.

- Improved Financial Literacy: Many programs provide educational resources to help workers understand their options.

Furthermore, workers can still decide to modify or opt-out of their contributions if they choose. This flexibility ensures individuals have control over their financial decisions without the burden of needing to enroll.

Many employees might not recognize the full impact of saving just a small percentage regularly. Auto-enrollment helps them make a habitual choice to contribute, ultimately leading to greater savings over time. Having an IRA as part of one’s payroll can significantly change the retirement landscape for many.

With a focus on financial responsibility, these benefits play a crucial role in helping workers feel secure about their future. Overall, the shift towards auto-enrollment programs demonstrates a commitment to fostering a culture of financial planning and security.

State initiatives and legislation

State initiatives and legislation regarding auto-enrollment IRA programs have transformed the way individuals think about retirement savings. Many states are recognizing the importance of encouraging people to save for their future and have taken steps to implement supportive laws.

In recent years, numerous states have introduced legislation aimed at making retirement savings more accessible. These initiatives often focus on specific goals, such as increasing participation rates among low-income workers or providing clear information about savings options. Each state has tailored its approach based on the needs of its residents.

Examples of State Legislation

Consider these examples of impactful state initiatives:

- California’s Secure Choice Program: This program requires employers who do not offer retirement plans to automatically enroll their employees in a state-managed IRA.

- Illinois’ Retirement Savings Plan: Illinois has implemented a similar program where workers are opted in automatically, helping to increase the number of people saving.

- New York’s Auto-Enrollment Law: This law mandates that businesses with five or more employees must offer an auto-enrollment IRA option, enhancing employee access to savings.

- Oregon’s Retirement Savings Program: Oregon was one of the first states to launch a state-sponsored retirement savings plan, allowing workers to save easily for their future.

These legislative efforts reflect a growing trend across the United States. They are designed to remove barriers to retirement savings, thus improving financial security for workers. With auto-enrollment features, these programs ensure that saving becomes a default action, making it convenient for employees.

Moreover, state governments often pair these initiatives with educational campaigns. By informing workers about the benefits of saving early, they enhance participation rates. The combination of strong legislative support and proper educational outreach contributes significantly to building a culture of savings.

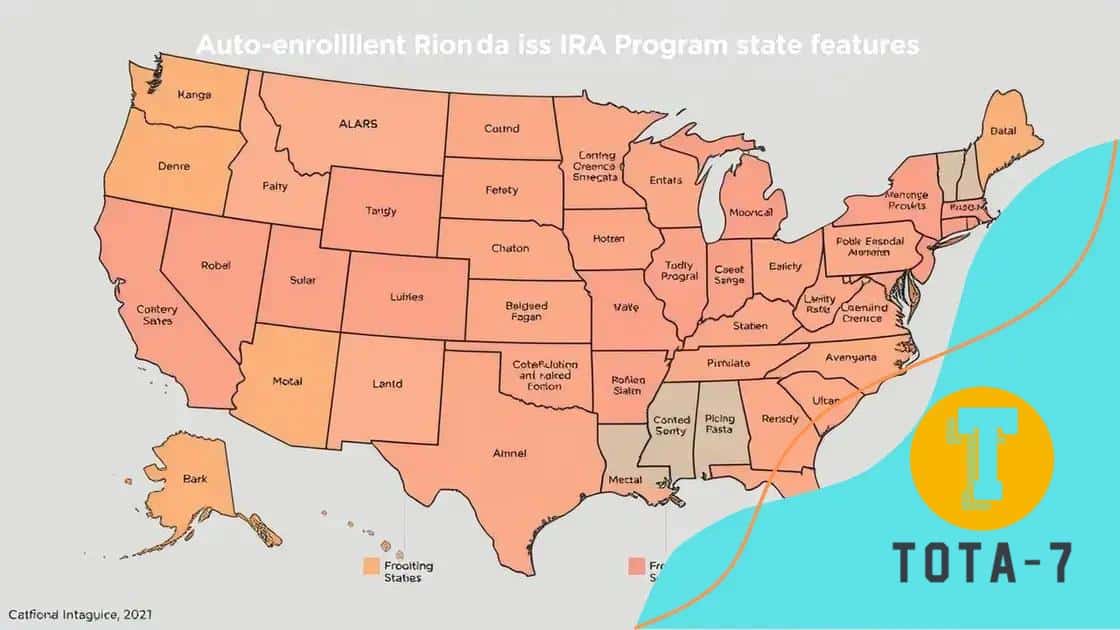

Comparative review of participating states

A comparative review of participating states in auto-enrollment IRA programs reveals significant differences in how each state implements these initiatives. Each state’s approach reflects its unique population needs, economic conditions, and political climate.

For instance, California, Illinois, and Oregon lead in terms of structured programs. These states have established guidelines that require employers to enroll their employees automatically in accessible retirement options. As a result, they see higher participation rates and greater public awareness about the importance of saving for retirement.

Key Features Across States

Each state’s program has its own distinctive features:

- California: The Secure Choice program mandates that employers without a retirement plan automatically enroll their workers in a state IRA.

- Illinois: Similar to California, Illinois offers an automatic system where workers are enrolled, enhancing savings opportunities.

- Oregon: This state has been a pioneer by launching the first state-sponsored auto-enrollment IRA, which set a precedent for others to follow.

- New York: New York’s approach includes robust informational campaigns aimed at helping employees understand their savings potential.

Additionally, states like Massachusetts and New Jersey have recently introduced plans aimed at addressing the retirement savings gap among their residents. These programs often vary in the contribution rates and the level of employer participation required. By understanding these differences, workers can better navigate their retirement options based on their residing state’s offerings.

As more states evaluate the success of their auto-enrollment IRA programs, they can learn best practices from each other, leading to innovation in retirement savings strategies. This comparative analysis highlights the importance of local policies in shaping the financial futures of workers throughout the United States.

How to maximize your retirement savings with these programs

To maximize your retirement savings with state-run auto-enrollment IRA programs, understanding how to navigate these options is key. These programs are designed to help you save effortlessly, but taking full advantage requires some proactive steps.

First, it’s important to actively participate. While auto-enrollment ensures that you start saving, you also have the power to increase your contributions. Many programs begin with a default savings rate of around 5%, but consider adjusting this rate to better align with your financial goals. Even a minor increase can significantly impact your savings over time due to the power of compound interest.

Strategies to Increase Savings

Here are some effective strategies for you to consider:

- Increase Contribution Rates: Review and adjust your contribution percentage as your salary increases or when your financial situation improves.

- Set New Goals: Regularly evaluate your retirement goals and adjust your savings plan accordingly.

- Take Advantage of Tax Benefits: Contributions to your IRA can lower your taxable income, allowing you to retain more of your earnings.

Furthermore, take the time to educate yourself about the investment options available within your IRA. Many programs offer a range of investment choices, from conservative to aggressive. Choosing investments that match your risk tolerance and time horizon can increase your savings potential.

Lastly, stay informed about any changes in the program or new features that may be introduced. Some states are continually refining their auto-enrollment IRAs to provide better benefits and resources. By being proactive and engaged, you can ensure that you are making the most of these programs for your future.

state-run auto-enrollment IRA programs can be a game-changer for your retirement savings. These programs are designed to make saving easier and more effective. By actively participating and adjusting your contributions, educating yourself about your options, and staying informed about changes in the law, you can set yourself up for a brighter financial future. Remember, starting small can lead to significant savings over time. Take control of your retirement today!

FAQ – Frequently Asked Questions about State-run Auto-enrollment IRA Programs

What are state-run auto-enrollment IRA programs?

These programs are designed to automatically enroll workers in retirement savings plans, helping them save without needing to sign up manually.

How does auto-enrollment benefit employees?

Auto-enrollment increases participation rates in retirement savings, simplifies the saving process, and encourages consistent contributions.

Can I change my contribution rate once enrolled?

Yes, employees can adjust their contribution rates at any time to fit their specific financial situations.

What steps can I take to maximize my savings?

Increase your contributions, educate yourself on investment options, and periodically review your savings goals to make informed adjustments.